Cheap Car Insurance in Hinesville, GA

In Hinesville, affordable car insurance is easy to find. With lower living costs, you can get budget-friendly coverage that meets Georgia’s minimum requirements, offering peace of mind without breaking the bank.

Everything You Need to Know About Auto Insurance in Hinesville, GA

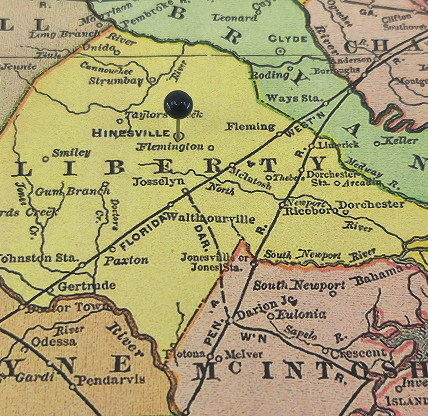

Living in a place like Hinesville, Georgia, really offers the best of both worlds. It’s got that small-town feel with plenty of modern conveniences, making it an ideal spot for both military families, thanks to the nearby Fort Stewart, and those looking for a quieter life.

With a history dating back to 1777, Hinesville has grown significantly since Fort Stewart was established in 1940, and today it’s home to parks, schools, and local spots. Getting around is easy, with major roads like U.S. Highway 84 and Georgia State Routes 119 and 196 connecting you to surrounding areas.

While traffic is usually light, be mindful of military traffic during peak hours. And like the rest of Georgia, it’s important to have the right car insurance. The state requires liability insurance to cover bodily injury and property damage in case of an accident. Not meeting these requirements can lead to fines or even a suspended license, so make sure you’re covered. Hinesville is a great place to live, but like anywhere, staying insured is key to safe driving.

How Much Does Car Insurance Cost in Hinesville, GA?

When it comes to car insurance, this city offers great rates. Liability coverage usually costs about $45 a month, while full coverage is around $129—both lower than state and national averages.

On a national scale, liability insurance typically costs $62, while full car coverage runs around $215.

Reasons Why Insurance is so Cheap in Georgia?

Car insurance in Georgia tends to be pretty affordable for a few key reasons. For one, the state has a lower population density, especially in smaller towns like Hinesville, which means less traffic and fewer accidents. Fewer accidents mean less risk for insurance companies, so rates are kept lower.

Plus, the insurance market here is super competitive, so companies are always trying to offer better rates to attract customers. Georgia also doesn’t face as many natural disasters, like hurricanes or floods, so the risk of major damage is lower, which helps keep premiums down.

On top of that, many insurers offer discounts for safe driving, bundling policies, or having good credit, which can lower your bill even more. Lastly, with car repairs and labor costs being lower in Georgia, overall insurance premiums tend to be more affordable. All these factors add up to make car insurance in Georgia a lot easier on your wallet.

Affordable Car Insurance Rates Comparison by Cities in Georgia

Your vehicle insurance cost varies by city, even within the same state, due to factors like car theft, accidents, traffic, and road conditions. Check the table below for average monthly premiums in different cities across Georgia.

Affordable Hinesville Car Insurance Rates by Zip Code

Coverage prices can vary within the same town based on factors like traffic, crime, and accident rates. Check out the table below to see how rates differ across Hinesville’s zip codes.

| Zip Code | Full Coverage Insurance | Liability Insurance Coverage |

|---|---|---|

| 31313 | $129 | $45 |

| 31315 | $129 | $46 |

Low-Cost Car Insurance Rates by Age in Hinesville

Car insurance rates can vary significantly based on age, as younger drivers typically face higher premiums due to their lack of experience and higher risk of accidents. As drivers get older and gain more experience, their rates generally decrease. To see how rates compare by age, check out the table below for a breakdown.

| Age | Full Coverage Insurance | Liability Insurance Coverage |

|---|---|---|

| Teenagers | $441 | $177 |

| 20s | $288 | $113 |

| 30s | $129 | $45 |

| 40s | $119 | $42 |

| 50s | $112 | $40 |

| 60s | $109 | $40 |

| 70s | $124 | $47 |

*We use the following methodology to arrive at our average cost: male, age 30, state minimum liability, and full coverage of 100/300/100.

Driving Conditions in Hinesville

Driving in this town is usually easy, with light traffic and well-maintained roads. The city’s lower population density helps keep commutes smooth and avoids the congestion you might find in bigger cities. For real-time updates, you can check sites like LocalConditions.com or WeatherBug for traffic and road conditions.

Georgia’s 511 system is also super helpful for statewide traffic info, and you can access it by dialing 511 or visiting their website. With these tools, you’ll be able to stay informed and make sure your drive around Hinesville is as smooth as possible.

How Many Car Accidents Happen in Hinesville

In 2023 alone, a total of 961 accidents were reported in Hinesville, with 1 of them resulting in fatalities. To avoid becoming part of these statistics, remember to stay focused while driving and never engage in drunk driving. Sometimes accidents are inevitable so opting in for a safer model car can greatly protect you and your family.

How Are the Road Infrastructure and Bridges in Hinesville?

Hinesville has been making great strides in improving its road infrastructure and bridges. One of the key projects is the South Main Street Streetscape, which focuses on replacing sewers, repaving, and adding new crosswalks to improve both the flow of traffic and the city’s appearance.

The goal is to make the area more inviting for residents and visitors. On a larger scale, Georgia has been committed to maintaining its bridges, with about 98% rated in good or fair condition. This helps ensure smooth travel across the state. However, military activity can sometimes create challenges, like when construction on the I-95 south Ogeechee River bridge causes traffic diversions onto local highways.

During these times, you might see more military vehicles on the roads, especially around Fort Stewart, so it’s important to drive with extra caution. Overall, Hinesville’s infrastructure is steadily improving, making for a smoother and safer driving experience.

Minimum Car Insurance Requirements in Hinesville

The minimum car insurance requirements follow the state’s guidelines, which include liability coverage with a minimum of $25,000 per person and $50,000 per accident for bodily injury liability.

For property damage, the minimum coverage is $25,000 per accident. These minimums are designed to cover damages you might cause to others in an accident. However, it’s important to remember that these amounts may not fully protect your assets in the event of a serious crash, so many drivers choose to purchase higher coverage limits for better protection. While optional coverages like collision, comprehensive, and uninsured motorist coverage are not required, they can offer additional security for both you and your vehicle.

What Are the Penalties for Driving Without Insurance in Hinesville

Georgia is cracking down on uninsured drivers and striving to reduce its position as one of the top states with high uninsured rates. If you’re caught without auto insurance, you could face:

- Up to one year in jail

- A $25 fine, plus an extra $160 if unpaid after 30 days

- A suspension of your license for 60 to 90 days

- Impoundment of your vehicle

- Fees to reinstate your license and penalties for not having continuous coverage

If an accident leads to injuries or fatalities, you may be charged with a felony, resulting in hefty fines or even imprisonment. It’s essential to have insurance to avoid these severe consequences.

Factors Allowed in Hinesville Car Insurance Rates

Have you ever thought about what factors impact the cost of your insurance in Hinesville? It’s not just your age and location that matter; insurance companies consider various elements, including:

- Driving Record: Clean records typically result in lower rates, while accidents or violations can increase premiums.

- Age and Gender: Younger drivers, especially males, generally face higher premiums due to higher accident rates.

- Vehicle Type: Newer or luxury cars may have higher premiums due to expensive repairs or replacement costs.

- Location: Areas with higher crime or traffic congestion can lead to higher rates.

- Coverage Levels: Higher coverage limits and additional protections can raise your premium.

- Driving Habits: Higher mileage or using your vehicle for business purposes can increase rates.

What Happens If I Damage Property?

If you damage property while driving in Hinesville, your property damage liability coverage should help pay for the repairs if you have it. Without this coverage, you’ll be responsible for the costs, which could add up quickly. If the property owner takes legal action, you might even face a lawsuit. That’s why it’s important to have the right insurance to avoid paying out of pocket or facing legal issues.

What are the Best Discounts for Car Insurance in Hinesville GA?

Georgia is an affordable state for car insurance compared to the national average, but in areas like Atlanta, discounts can play a significant role in lowering your premiums. In Hinesville, you may be eligible for several discounts that can help reduce your rates:

Get a Quote for Car Insurance Coverage in Hinesville Today!

Drive with confidence and save big in Hinesville and across Georgia with Southern Harvest. Our team is here to find you the best, budget-friendly car insurance. Getting a quote is free, easy and quick—simply do it online, visit one of our nearby offices, or give us a call at 877-831-4677.